This method records both invoices and bills even if they haven’t been paid yet. This is a highly recommended method because it tells the company’s financial status based on known incoming and outgoing funds. Because the funds are accounted for in the bookkeeping, you use the data to determine growth. At the end of every pay period, the bookkeeper will accumulate employee payroll details that include hours worked and rates.

- Accounts receivable is the money that other entities owe to your business.

- Please do not copy, reproduce, modify, distribute or disburse without express consent from Sage.

- Generally, accrual-based is the recommended accounting method, but the decision is ultimately up to you.

- If you fall below the £85,000 threshold, it may be beneficial for you to voluntarily register.

- Even if you aren’t planning on growing any time soon, you need to have a sense of how much money is coming in versus what is going out.

The integration with Patriot’s payroll application is a definite plus, but the accounting side lacks depth in areas like contact records, inventory, time tracking, and merchant account choice. Its price, voluminous support, and usability make it a great choice for a novice or a small startup. Patriot Software has a payroll application, which we’ve reviewed for years, and we wanted to see what the company’s integrated accounting counterpart was like. accounts expenses Uncomplicated navigation, an attractive, intuitive UI, and exceptional mobile access add to its appeal. It’s missing some features that competitors offer, and it includes some language and concepts that rivals keep in the background, but it’s a solid, inexpensive solution. Enterprise resource planning (ERP) software includes all the features of accounting software, plus additional features such as CRM, inventory management and project management.

Steps to managing your business accounting

You can start forecasting cash flow once you have a month’s sales behind you. The software can automatically match up income and outgoing on the bank statement with invoices you’ve sent and things you’ve paid for. A good small business accounting solution can take care of all your vital business information and present it in an at-a-glance view to help you make the right decisions. In this guide, you’ll learn everything you need to know about how to start keeping books for a small business.

Business accounting differs from other types of accounting in a few ways. One significant way this type of accounting differs from other accounting methods, like financial accounting, is that there are no compliance regulations. Business accounting also does not focus on long-term financial decisions but on internal tasks within the company. As you grow your client roster, you’ll want to make sure you’re tracking them effectively and completely.

Bookkeeping and small business legislation

In the cloud, you have access to your business data any where with an internet connection, on any device. All your data is in one place so you’ll always have access to the latest data even with multiple collaborators like your bookkeeper or your accountant. See how you can track and manage your whole financial picture in one place—from bank transactions, expenses, and beyond. I appreciate how it tracks clients/customers, tracks payments, [and] keeps running calculations of what is due and when.

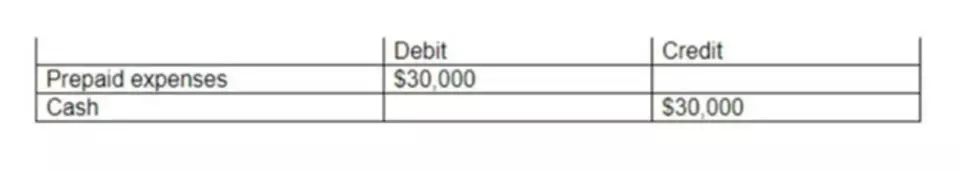

Double-entry accounting enters every transaction twice, as both a debit and a credit, to “balance the books” between accounts. Although more complicated, it can prevent errors in recording transactions. These record templates vary in complexity, so you need to understand the differences before you go with one accounting service or another.

Track your financials

You should be familiar with more than one software as some of your clients may have a preference in terms of the accounting software that they’d like you to use. You don’t have to hire a full-time bookkeeper or accountant to keep your finances organized. Outsource specific financial tasks to a tax professional who is experienced in handling business accounts. Investing in different areas of your business can be an important next step.

Digits AI Debuts as World’s First Secure, Accurate, Business Finance AI – Yahoo Finance

Digits AI Debuts as World’s First Secure, Accurate, Business Finance AI.

Posted: Thu, 22 Jun 2023 13:00:00 GMT [source]

This can include estimating the eventual value of a finished project, preparing and sending invoices and providing statements. This includes importing and categorizing transactions properly, reconciling these transactions and making sure they’re recorded according to your entry system and accounting method. Not all accounting software is created equal, but not every business needs the same set of accounting features. Its Sage Accounting plan normally costs $25 per month, but it offers 70% off your first six months, so you end up paying $7.50 per month.

Review inventory.

All the accounting services included here let you add customers, vendors, and products during the process of completing transactions. You need to do so anyway as you grow and add to your contact and inventory databases. You just have to decide whether you want to spend the time upfront building your records or take time out when you’re in the middle of sales or purchase forms.

Both disciplines work hand in hand to determine the financial health of a business. Bookkeepers can benefit your business by freeing up more time in your schedule, minimizing financial errors, and generating accurate financial reports. Working with a bookkeeper can also help ensure your books stay clean and up to date so you’re always ready when tax season rolls around.